The motorcycle market finds its balance in April

The motorcycle market in France, after going through a period of turmoil, begins to show signs of stabilization in April 2025. Despite a slight decrease in registrations compared to the previous year, players in the sector observe an encouraging dynamic, particularly thanks to popular models and adapted business strategies. This article examines in detail the trends and nuances of the motorcycle market, highlighting various manufacturers, sales segments, and the evolution of regulatory standards affecting this sector.

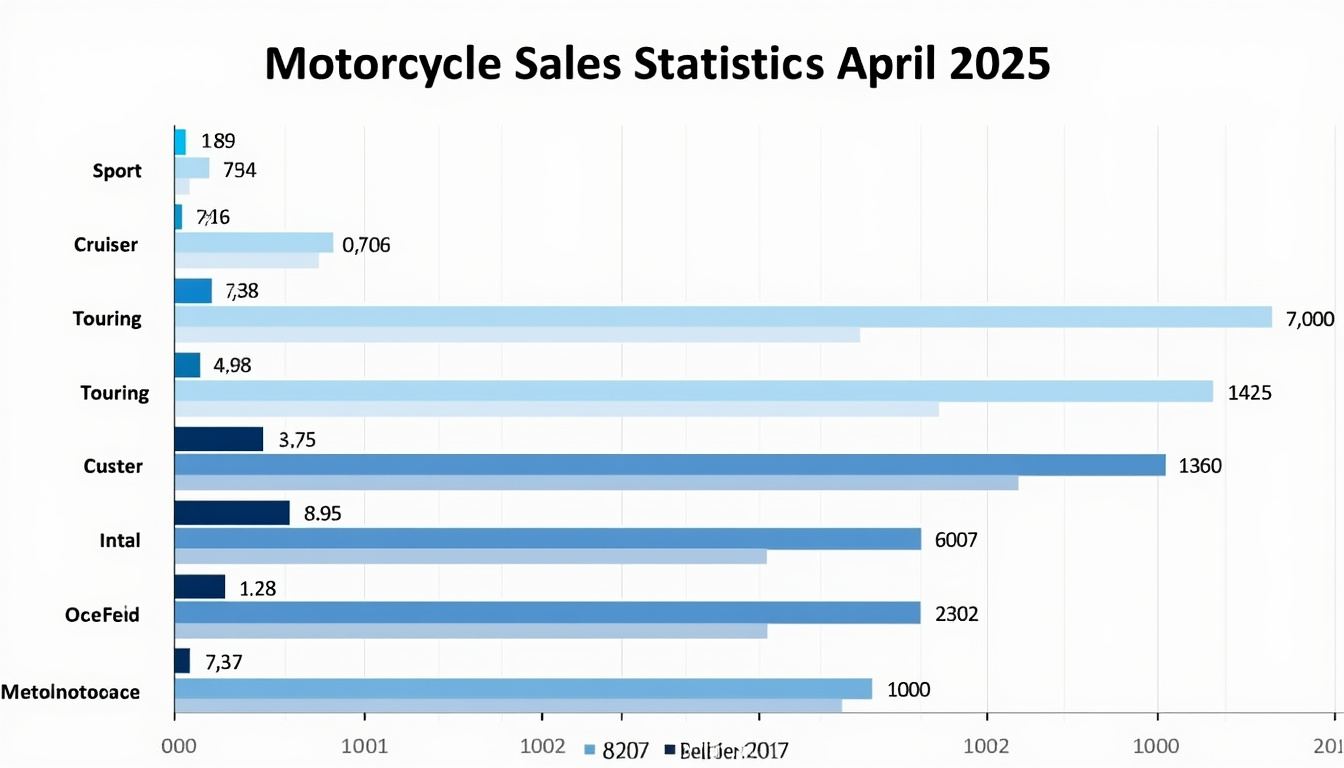

Analysis of Motorcycle and Scooter Sales in April 2025

In April 2025, the French market for motorcycles and scooters recorded 19,174 registrations of vehicles over 125 cc. Although this figure represents a decline of 5.7% compared to the previous year, it is essential to consider the broader context in which this trend is situated. Since the beginning of the year, registrations have dropped by 15.9%, but the decline is less pronounced than in the first quarter, where the drop was 20.4%.

Factors Influencing Sales in 2025

The market performance is directly related to several key factors:

- The impact of Euro 5+ standard: The implementation of this new standard generated a spike in sales at the end of last year, creating a domino effect that disrupted the figures for 2025. Consumers advanced their purchases, causing a drop in sales at the beginning of the year.

- Seasonal dynamics: With improving weather conditions, sales generally start to increase with the arrival of spring. This phenomenon also impacted the figures for April.

- Manufacturers' strategies: Major players like Honda, Yamaha, and BMW are adopting aggressive marketing strategies. New models are thus likely to experience increased success upon their launch.

Additionally, it is important to note that figures vary significantly between different manufacturers. For example, Triumph recorded an increase of 18% in its sales, while BMW saw a decline of 15% for its flagship model, the R 1300 GS.

Comparison of Brands and Their Performance in April

Japanese brands, in particular, have shown some resilience in this difficult context. Yamaha experienced a decline of 3.57% in its sales, but this is attributed to the late arrival of new models at dealerships. In contrast, Kawasaki and Honda maintain a fairly stable position, their success attributed to well-established models.

| Brand | Sales change (%) | Best-selling model | Units sold |

|---|---|---|---|

| BMW | -15 | R 1300 GS | 658 |

| Yamaha | -3.57 | TMAX 560 | 582 |

| Kawasaki | Stable | Z900 | 440 |

| Triumph | +18 | Model not specified | Not provided |

This table clearly illustrates the variation in performances in the market, highlighting the importance of flagship models and new offerings in the sales dynamics.

Market Segments: Where Are the Performances?

A detailed analysis of the market segments for April 2025 reveals interesting trends. Motorcycles over 125 cc dominate sales, but each sub-segment has distinct characteristics.

Performance by Engine Displacement Segment

The data shows that the engine displacement segments over 125 cc are clearly the best performers, attracting more buyers. Here are the key statistics:

- Motorcycles over 125 cc: Main segment with sales of 19,174 units.

- 3-wheeled vehicles: In decline, with significantly reduced sales. Future regulations could push for necessary adaptations in this market.

- Electric motorcycles: Still stagnating due to lack of purchasing incentives, sales have dropped by 17.6% since the beginning of the year.

Some brands, like Vespa in the scooter segment, continue to capture consumer attention with well-established models. Nevertheless, the declining appeal of smaller and electric models remains a persistent issue.

Trends in Consumer Preferences

Today's consumers are increasingly concerned about the environmental impact of their choices. This translates into a growing interest in electric models, despite their low performance to date. Electric motorcycles are perceived as a future, but the lack of government support makes them less appealing.

The trend towards more sustainable mobility will require manufacturers, including brands like Harley-Davidson and Ducati, to adapt their offerings to meet this demand. It will be essential for them to innovate in their product ranges.

Challenges Facing the Motorcycle Market

While signs of stabilization are observable, the motorcycle market faces several persistent challenges. Among these are global economic difficulties, regulatory changes, and increased competition from other modes of transport. A more in-depth analysis is needed to understand the full range of issues.

Economic Issues

The global economic situation directly impacts consumers' purchasing power. Rising raw material prices, combined with inflation, affect purchasing decisions. Motorcycles are often considered luxury items, which can hinder sales during difficult periods.

- Price increases: Price hikes can deter potential buyers.

- Maintenance costs: The perception of motorcycle maintenance costs can also play a role.

Regulatory Pressures

New regulations, such as those related to the environment, impose stricter standards, particularly with the adoption of standards like Euro 5+. These laws encourage consumers to favor compliant models, but they can also complicate some manufacturers' efforts to adapt quickly. The transition to more environmentally-friendly models must be supported by the provision of purchase aids.

Future Outlook for the Motorcycle Market

The outlook for the motorcycle market is shaped by innovation and adaptation, as well as a collective response to contemporary challenges. Brands must not only comply with regulations but also anticipate rapidly changing consumer expectations. The coming years could be crucial in redefining the identity and image of motorcycles through sustainable, affordable, and technologically advanced options.

What innovations will be necessary to revitalize the motorcycle market? It is clear that the future will heavily depend on manufacturers' ability to seize new opportunities while remaining attentive to their customer bases. The sector must not only adapt but also anticipate potential changes and clearly communicate the new expectations related to electric vehicles and responsible driving.

Source: www.lerepairedesmotards.com

Leave a Reply

Articles relatifs